Why Are Automotive Warranty Claims So Challenging?

Automotive warranty claims are anything but routine. Each claim can be a puzzle, involving high-value repairs, multiple components, and sometimes only partial approvals – such as covering labor but not towing. The real challenge lies in the details: some claims are straightforward, but others demand expert judgment, especially when subjective factors like customer goodwill or local business practices come into play.

Complexity escalates with high-value or technically intricate repairs, cross-border parts returns, or ambiguous warranty status due to missing service records. Goodwill claims – where relationships and reputation are at stake – add another layer of difficulty. Non-standard costs, mismatched documentation, and unique contract terms for every client or vehicle model mean that no two claims are ever quite the same. The process is further complicated by the need for physical inspections and the lack of integration between dealer and supplier systems, making every step a potential bottleneck.

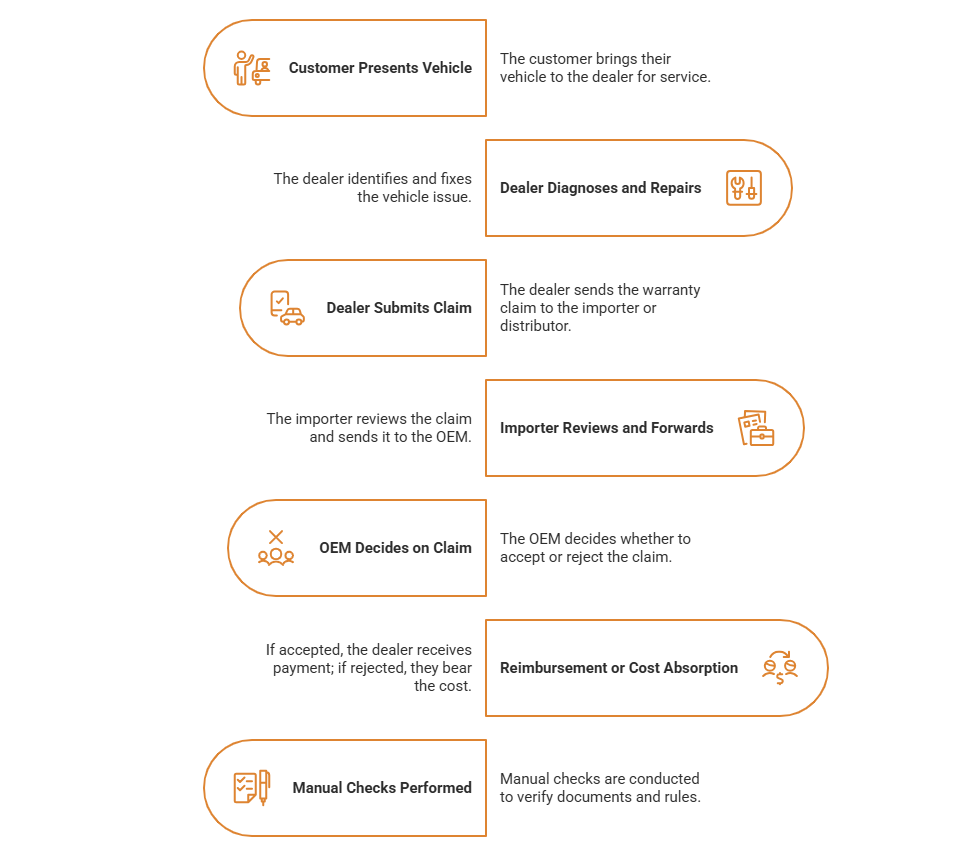

The Warranty Claims Process: An Overview

Why Was the Process Designed This Way?

Importers and distributors are positioned between dealers and manufacturers, with a primary goal of maintaining strong dealer relationships. To avoid conflict, claims are often forwarded with minimal challenge, even if this means absorbing costs. Warranty terms are frequently custom-negotiated, cost structures are intricate, and documentation errors are frequent. Limited system integration has made manual checks the default approach.

The Risks of Maintaining the Status Quo

If nothing changed, the risks would only grow. Financial losses from auto-approving unverified claims would continue to mount, draining resources that could be better spent elsewhere. Experts would remain bogged down in routine cases, unable to give complex claims the attention they deserve. The organization would be forced to hire more staff just to keep up, driving up operational costs. Errors and inconsistencies would become more common, and goodwill-based approvals could spiral out of control, undermining financial discipline. Most critically, the lack of transparency and auditability would make it nearly impossible to maintain oversight or build trust with dealers and OEMs. Over time, these issues could erode relationships and damage the company’s reputation in the market.

The Vision for Improvement: A New Approach with Artificial Intelligence, Machine Learning and Neural Networks

Now, imagine a different future – one where technology takes on the heavy lifting. Instead of relying solely on human expertise, the organisation introduces artificial intelligence and machine learning, specifically leveraging AI neural networks. These networks are designed to mimic the way human brains process information, learning from vast amounts of historical claims data and expert decisions. Over time, they become adept at spotting patterns, assessing risk, and making recommendations.

In this new model, routine, low-risk claims are automatically processed, freeing up experts to focus on the truly complex cases. The AI continuously learns from expert feedback, refining its decision-making abilities. It can even handle partial acceptances, approving or rejecting individual items within a claim. Document validation is automated, and every decision – whether made by AI or a human – is logged for full transparency. The result is a system that not only integrates seamlessly with existing workflows but also grows smarter and more reliable with every claim it processes.

How the Solution Works in Practice?

When a client submits a claim, the system immediately checks all supporting documents and invoices for accuracy. The AI reviews the claim against contract terms, flagging anything that seems out of the ordinary or potentially outside warranty coverage. For straightforward cases, the AI recommends acceptance, rejection, or partial approval, complete with a confidence score. Claims that fall below certain risk or value thresholds are processed automatically, while more complex cases are escalated to human experts.

But the process doesn’t stop there. The AI model is continuously updated with new outcomes, learning from every decision – right or wrong. Experts periodically review samples of auto-processed claims to ensure quality and consistency, and every manual override is tracked, creating a robust audit trail. This dynamic, feedback-driven approach ensures that the system remains accurate, transparent, and aligned with business goals.

Tangible Benefits: More Than Just Efficiency

The benefits of this transformation are both immediate and far-reaching. Claims are processed faster, ensuring compliance with regulatory deadlines and eliminating the costly risk of auto-approvals. Expert resources are finally focused where they matter most – on complex, high-value claims that require true judgment and experience. Operational costs drop as the need for additional staff diminishes, and decision-making becomes more consistent and objective.

Financial control is strengthened, with fewer unjustified claims slipping through the cracks. Every decision is transparent and auditable, building trust with stakeholders and regulators alike. Perhaps most importantly, the process becomes scalable – capable of handling increased claim volumes without sacrificing quality or control. This is not just an upgrade; it’s a strategic shift that positions the organization for sustainable growth and long-term success.

Getting Started with AI in Warranty Claims

Organizations seeking to implement AI in warranty claims management should:

- Map current processes and identify pain points.

- Gather historical claim data for AI training.

- Define clear objectives (e.g., reduced processing time, improved accuracy).

- Select technology that integrates with existing systems.

- Plan for process adjustments and feedback mechanisms.

- Involve both technical and business stakeholders from the outset.

- Launch a pilot focused on simple claims, then scale the solution.

Implementing artificial intelligence into your automotive warranty claims management process isnt just about cranking up productivity – its a complete sea change that lets you get a handle on costs, get your processes moving a lot faster, and put your most valuable people working on the things that really matter. By automating the work that doesn’t actually need a human touch, that lets your top talent handle the really tough cases while still keeping everything open and above board – and making sure you’re never going to run into any regulatory trouble.

Want to find out how Hicron Automotive Blackbelts can help you team transform the way you handle warranty claims with AI? Get in touch with our team of experts and lets make a plan for getting a brand new system running quickly and safely – one that really brings a noticeable boost in efficiency, really slashes the risk, and unlocks the full potential of your most valuable people.

Check our AI solution 👉 Transform Warranty Management with HICRON